Ecommerce in 2025 is more complicated than ever. With constant changes in attribution models, increasing pressure to prove ROI, and evolving consumer behaviors, it’s easy to feel lost in the data.

Many ecommerce businesses struggle to figure out which metrics really matter, and which ones are just noise. The most important metrics are the ones that tell a clear story about your bottom line—and your projected growth.

That’s why focusing on these four key metrics is so important. By honing in on what counts, you’ll not only make better decisions but also gain a clearer path to sustainable success.

Let’s get into it.

Understanding and focusing on the right metrics is what separates successful ecommerce businesses from those that struggle to grow. While there are countless metrics you could track, these four—customer acquisition, profitability, revenue, and cost of goods sold—are the foundation for sustainable growth.

They don’t just offer data; they tell the story of your business’s financial health, growth potential, and ability to compete in the market.

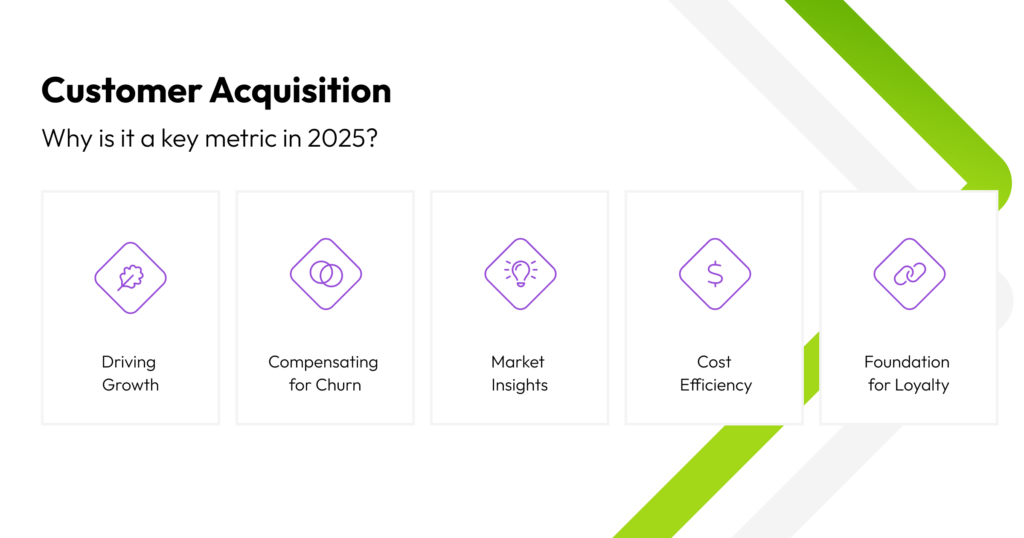

Acquiring new customers is one of the most important ways to fuel growth, especially in competitive industries.

Net new customers—the first-time buyers entering your ecosystem—are a clear indicator of your business’s ability to expand its reach and replace churned customers.

Why does customer acquisition matter? It offsets churn, grows your customer base, and ensures sustained revenue growth. Businesses that consistently attract and convert new customers are better positioned to thrive in any market condition.

We’ll talk a bit more about this later.

Revenue is one of the easiest metrics to measure, but it’s also one of the most revealing. Your revenue tells the story of your growth trajectory and ability to reinvest in your business. It helps you determine resource allocation, predict cash flow, and understand which areas of your business are driving the most value.

For example, if subscription revenue is outpacing one-time purchases, you might allocate more resources to expand and support that channel. Revenue also acts as a signal to investors, showcasing the growth potential of your business.

Cost of Goods Sold (COGS) directly impacts your profit margins and helps you understand the true cost of running your business. By closely monitoring COGS, you can identify inefficiencies and take steps to improve operational performance.

In today’s ecommerce landscape, where inflation and supply chain challenges persist, keeping a close eye on COGS is critical.

For example, businesses that streamline production processes or negotiate better supplier terms can reduce costs, improve pricing competitiveness, and ultimately boost profitability. Understanding COGS also allows you to make smarter decisions about pricing strategy, helping you remain competitive without sacrificing margins.

What It Is

Profitability, simply put, is your revenue minus costs. However, how businesses measure profitability can vary depending on their growth stage or industry.

For instance, newer ecommerce businesses might focus on gross margin as they prioritize reinvestment and scaling, while more established companies could track net profit to evaluate long-term financial health and shareholder returns.

Similarly, ecommerce brands in competitive industries may also consider contribution margin to understand profitability per product or category. It’s the ultimate indicator of your business’s health and viability.

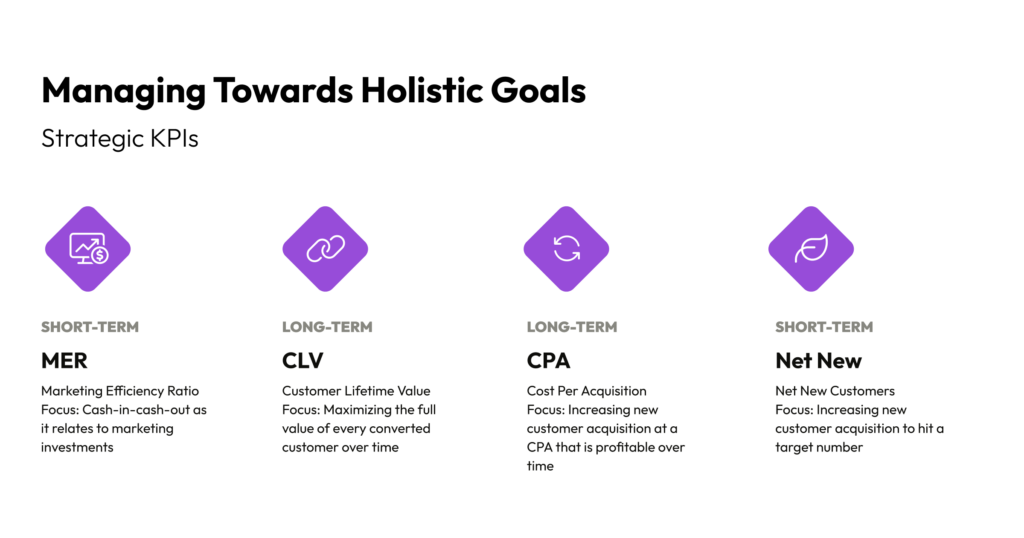

While customer acquisition, profitability, revenue, and cost of goods are critical, there are additional KPIs that can provide valuable insights into your business’s performance. Metrics like Media Efficiency Ratio (MER), CLV-to-CPA ratio, and net new customers help businesses refine their strategies and stay competitive in a complex ecommerce landscape.

1. Media Efficiency Ratio (MER): The Ultimate Holistic Metric

What It Is

Media Efficiency Ratio (MER) is the ratio of your total paid media spend to your total site-wide revenue. In 2025, MER has become increasingly important as attribution models evolve and platform-reported metrics become less reliable, making it a key tool for transparency and decision-making.

“If you’re just looking at platform-reported ROAS, you’re not seeing the whole picture. Media Efficiency Ratio tells you how much your paid media contributes to your site-wide revenue—it’s a true holistic metric,” says Megan Houston, Managing Partner at Agital.

Unlike platform-specific metrics like ROAS, MER provides a comprehensive view of how effectively your paid media investments are contributing to your overall revenue.

Why It Matters

Attribution discrepancies across platforms are a common challenge for marketers. Google might claim your campaign generated $100,000, Meta might say $50,000, and Criteo could report another $30,000—adding up to more revenue than you actually made sitewide. MER sidesteps these inconsistencies by focusing on total site-wide revenue.

Pro Tip: Instead of relying solely on platform-reported ROAS, track your MER monthly to get a clearer sense of overall performance and efficiency.

2. Customer Lifetime Value (CLV) vs. Cost Per Acquisition (CPA)

What It Is

This ratio measures the long-term value a customer brings to your business (CLV) compared to the cost of acquiring them (CPA). A healthy CLV-to-CPA ratio ensures that your investments in customer acquisition are yielding profitable returns.

Why It Matters

Understanding your CLV-to-CPA ratio is key to forecasting profitability and scaling your customer acquisition strategy with confidence.

“Knowing your CLV-to-CPA ratio allows you to forecast profitability and take calculated risks to grow your customer base,” explains Meghan. Many ecommerce businesses aim for a 3:1 ratio—where CLV is three times the CPA within 12 months—as a benchmark for sustainable growth.

This balance ensures that your customer acquisition costs are not just covered but are driving meaningful returns.

Pro Tip: Calculate your 12-month CLV and benchmark it against your CPA. If your ratio isn’t where you want it to be, focus on improving retention or increasing average order values to boost CLV. If it’s over efficient, you have room to scale!

3. Net New Customers: A Key Indicator of Growth

What It Is

Net new customers refer to first-time buyers entering your ecosystem. For example, an ecommerce business we worked with shifted their focus to acquiring net new customers through targeted paid social campaigns and optimized their landing pages for first-time buyers.

This approach resulted in a 25% increase in new customer acquisition within three months, fueling their overall growth and market share. Tracking this metric gives you a clear picture of how effectively your marketing efforts are expanding your customer base.

“Acquiring new customers replenishes your base, ensuring growth even as some customers churn,” says Meghan.

Why It Matters

Acquiring new customers offsets churn and ensures sustained revenue growth. It’s especially important for businesses aiming to increase market share and build long-term loyalty.

Pro Tip: Analyze acquisition sources to determine which channels deliver the highest-quality leads at the lowest cost. Invest more in these channels to scale efficiently.

Tracking these four key KPIs—MER, CLV vs. CPA, net new customers, and profitability—will provide a clear framework for measuring success and making informed decisions in 2025.

These KPIs are critical because they align with current trends such as the growing importance of holistic attribution models, the need for efficient customer acquisition strategies, and the emphasis on profitability amid economic uncertainties.

They not only align with executive-level goals but also offer actionable insights to optimize your marketing strategies.

If you’re unsure where to start, we can help.

Ready to refine your metrics strategy? Request a free 1-on-1 personalized audit to identify growth opportunities tailored to your business goals.

Whether it’s improving SEO, email performance, or paid ads, our team will provide actionable insights to help you achieve your growth objectives.